Let us be honest… You are now in the best position you will ever be to build up your wealth, you are what everyone refers to as DINKs. (If you feel a hint of jealousy in their tone… it’s not your imagination).

This is the best time for you to set yourself up and give yourself the best opportunity at having a bright financial future. If you can’t make it now, well, let’s just say it doesn’t get any easier…

One of the most important things to start planning ahead as a couple is honesty and transparency. I am still surprised at the amount of times we see clients who have accounts or credit cards the other partner was unaware of (let me tell you, that’s never a fun conversation to be caught in).

Being transparent and honest about your finances, doesn’t mean you have to give up control of your money. However, it does mean telling each other where things are at, and how you would like to enjoy your money.

“Being transparent and honest about your finances doesn’t mean you have to give up control of your money”

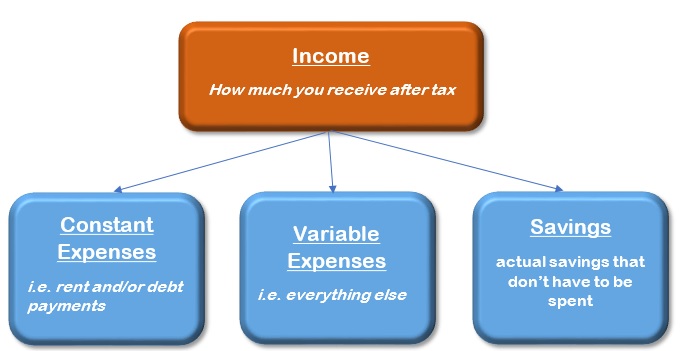

Once that is taken care of, the next stage of planning can commence. You can start working out how much money is coming in and how much is going out. The income part is the easy bit, I would suggest starting with that -payslips and bank details usually help-. Once you know how much income you are generating, you can start working out how much you are spending, now this is where things get tricky and most people just give up. To get you started, try using this method:

- Add up all of your net income

- Work out your fixed or constant expenses i.e. rent/mortgage and minimum loan payments

- Work out if you have any actual savings? i.e. are your savings constantly growing

- If yes, roughly how much you are setting aside

- If no, then this is zero and everything else goes towards your variable expenses

- Do the following: Income – Constant expenses – Savings = Variable expenses

- Voilà, you have just worked out how much your expenses are!

Besides moving to a cheaper place, there is generally very little which can be changed about constant expenses; this means that in order to increase your savings, you need to reduce your variable expenses. While this may sound straight forward, this simple exercise can often help improve the awareness of how much money is being spent away.

Once you know much money you are spending, it is time to decide how much you would like to start saving and for what purpose. Having a clear goal in mind, makes it easier to avoid spending money on frivolous things and focus on saving towards your goals.

Did you know? If you buy two cups of coffee at work, you are spending around $1,800 a year just on coffee!

In future posts we will further discuss setting goals and working towards those goals. Think about what sort of things you would like to achieve financially and write them down, things like purchasing your first home, taking a holiday, starting a family, etc…

If you would like some help with setting goals or working out your budget, give us a call.